Received ARPA Funds? Become Familiar with the Obligation Interim Final Rule

Nearly all 536 cities in Georgia were recipients of COVID-19 relief funds from the US Department of the Treasury through the American Rescue Plan Act (ARPA) of 2021. The April 30 Project and Expenditure deadline for most cities has just passed, but 2024 remains a critical year. Why? All ARPA funds must be obligated by December 31. Funds must then be fully expended by December 31, 2026.

Missing these deadlines means having to return unobligated funds to the US Treasury and being considered “non-compliant,” with the risk of not being eligible for further federal funding.

“Obligating ARPA” and New Guidance

Treasury defines “obligation” as: An order placed for property and services and entering into contracts, subawards, and similar transactions that require payment. (31 CFR 35.3 or FAQ 13.17)

Cities and other ARPA recipients have raised numerous questions about the requirements surrounding this term and the process of “obligating ARPA funds.” In an effort to provide clarity and quell stakeholder concerns, Treasury has been rolling out guidance and delivering webinars to walk through the guidance.

The Obligation Interim Final Rule (IFR) that was released in November 2023 reflect several clarifications and updates that are favorable to cities. Even if your city has already obligated all of its ARPA funds, you will want to review the IFR and the IFR Quick Reference Guide to get ahead of any unexpected turn of events and put contingencies in place before December 31, 2024. Note: in a May 8 webinar, Treasury staff indicated that there will be no Final Rule released, so this IFR is the guidance to follow.

For instance:

- What happens if a contract using ARPA SLFRF funds falls through after 12/31/24?

- What happens if an employee whose payroll expenses are paid by ARPA ends up leaving after 12/31/24?

- What happens if costs for a project funded by ARPA end up being higher or lower than budgeted for after 12/31/24?

The Obligation IFR seeks to outline the allowable courses of action a city can take in the event any of these situations arises after the 12/31/24 obligation deadline.

New FAQs

Treasury has also updated their FAQs with a dedicated section (#17) on ARPA obligations: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule-FAQ.pdf

These FAQs explain:

- That Treasury considers an interagency agreement (i.e. MOU) to constitute an obligation if the agreement meets certain conditions.

- That Treasury considers a recipient to have incurred an obligation for personnel costs for an employee if the employee is serving in a position that was established and filled prior to the obligation deadline (12/31/24).

- How recipients may cover costs increases for contracts that were entered into prior to the obligation deadline, but have costs increases after the obligation deadline has passed.

Deadline Extension for Specific Costs

Most ARPA award recipients will have received an email from Treasury around March 27 about a deadline extension “for estimated costs associated with certain administrative and legal requirements.” This deadline has been extended to April 30, 2025 for annual reporters and July 31, 2024 for quarterly reporters. This does not change the Project and Expenditure reporting deadline for most cities, which remains April 30 of each year through 2027. The March 27 notice refers only to a specific type of cost.

While cities need only provide estimates of such costs and they are not mandatory to report, it is strongly recommended they do so to avoid underreporting and having to return unobligated funds to Treasury.

Final Remarks

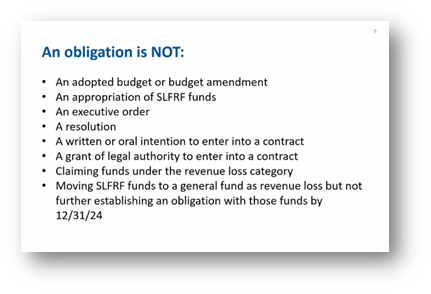

Remember that taking the Standard Allowance of up to $10 million, designating the funds as “revenue replacement” and moving your ARPA dollars to the city’s general fund do NOT constitute an obligation. Neither does any of the following:

Screenshot of slide from May 8 webinar by the US Treasury

As always, consult your city attorney on all Treasury guidance governing the use of ARPA funds.

Resources

Treasury SLFRF Reporting and Compliance

Obligation Interim Final Rule (November 2023)

Obligation IFR Quick Reference Guide

Contact

Claire Chan, (470) 484-6705

Published on May 8, 2024

Back to Listing